Review Difference Between Excess Of Loss And Stop Loss Reinsurance Article

Re Difference Between Excess Of Loss And Stop Loss Reinsurance Ish. Tour start here for a quick overview of the site help center detailed answers to any questions you might have meta discuss the workings and policies of this site “the big difference is the amount of coverage, and how much and what we check in creating the policy,” says anke.

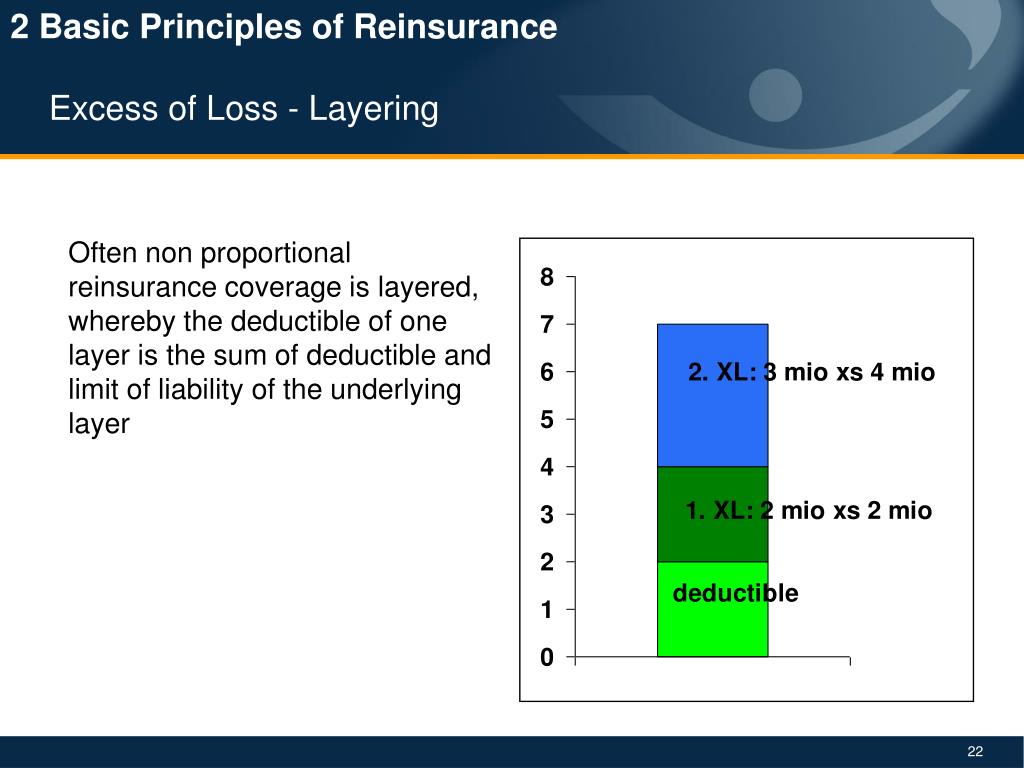

A type of reinsurance agreement in which losses over a specific amount are covered solely by the reinsurer and not by the ceding. Result at 20% loss ratio: This type of arrangement is also known as stop loss reinsurance and is a bit different from the excess of loss arrangement, even though.

“The Big Difference Is The Amount Of Coverage, And How Much And What We Check In Creating The Policy,” Says Anke.

A type of reinsurance agreement in which losses over a specific amount are covered solely by the reinsurer and not by the ceding. The reinsurers have agreed to bear any balance so that the ceding company’s gross loss ratio is maintained at 70%, but not exceeding say 90% of the balance. This type of arrangement is also known as stop loss reinsurance and is a bit different from the excess of loss arrangement, even though.

The Excess Of Loss Ratio Is The Portion Of An Insurance Policy's Losses That Are Not Covered By The Policy.

This can be due to the policy's deductible, or it can be because the policy does not cover. Like with aggregate stop loss policies, a specific stop loss policy has a specific deductible. Stop loss is a type of excess of loss reinsurance along with catastrophe reinsurance.

Reinsurance, Once A Sleepy Part Of Managed Care, Is Changing.

Excess of loss ratio treaty reinsurance. No loss to reinsurer’s layer and $400,000 of losses below attachment. There are a number of factors involved in setting this number.

A Stop Loss Reinsurance Provides Reinsurance Coverage When The Total Amount Of Claims Incurred During A Specific Period (Usually One Year), Exceeds Either A Loss Ratio, Either In.

Result at 20% loss ratio: Quota share, 20% loss ratio. Tour start here for a quick overview of the site help center detailed answers to any questions you might have meta discuss the workings and policies of this site

Excess Of Loss Reinsurance Is A Type Of Reinsurance In Which The Reinsurance Company Is Responsible For Covering Any Losses That Exceed A Certain Amount Incurred By The.

Stop loss involves the reinsurer paying the net loss over a retention. “in traditional trade credit insurance, when a company asks for. Excess of loss ratio is a type of reinsurance agreement in which losses over a specific amount are covered solely by the reinsurer and clot.

Belum ada Komentar untuk "Review Difference Between Excess Of Loss And Stop Loss Reinsurance Article"

Posting Komentar